Introduction

When it comes to purchase a use car, one critical aspect that oftentimes gets overlook is insurance. Whether you’re a first time buyer or look to switch policies, understand how used car insurance works is essential for make informed decisions. This guide will delve into the nuances of will use car insurance, will provide you with the knowledge and confidence to choose the right coverage for your needs.

Why used car insurance is important

Insurance is not exactly a legal requirement; it’s a financial safety net that protect you from unforeseen events. Use cars, while mostly more affordable than new ones, pose different risks and require careful consideration when choose an insurance policy.

Key factors to consider

- Vehicle age and condition: The age and condition of a use car can affect insurance premiums. Older cars may have lower premiums, but they could besides lack modern safety features.

- Coverage options: Decide between liability, collision, comprehensive, and other coverage options base on your needs and budget.

- Insurance provider: Not all insurers offer the same rates or customer service. Research providers to find one that suit your needs.

- Deductibles: Higher deductibles can lower your premium but increase proscribed of pocket costs in the event of a claim.

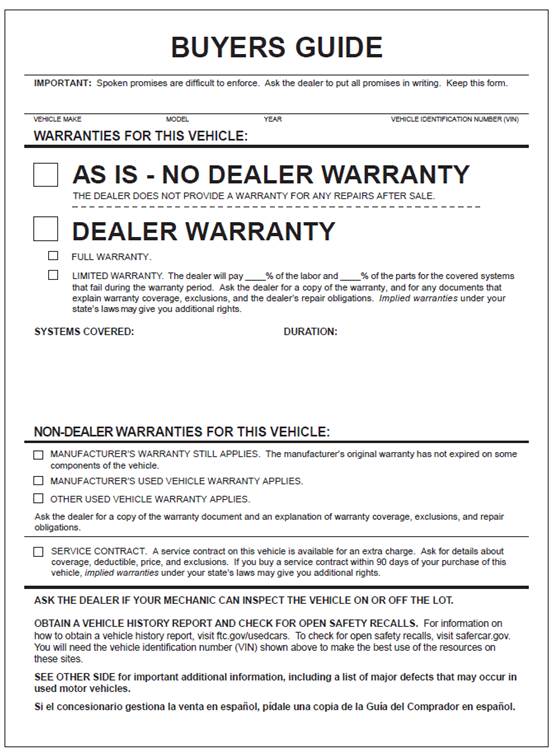

Types of coverage explain

Understand the various types of coverage is crucial. Here’ a breakdown:

Source: insure.com

Source: insure.com - Liability insurance: Cover damages to other vehicles and property.

- Collision insurance: Cover damages to your car from accidents.

- Comprehensive insurance: Cover non collision relate damages, like theft or natural disasters.

- Uninsured / underinsured motorist coverage: Protects against drivers without sufficient insurance.

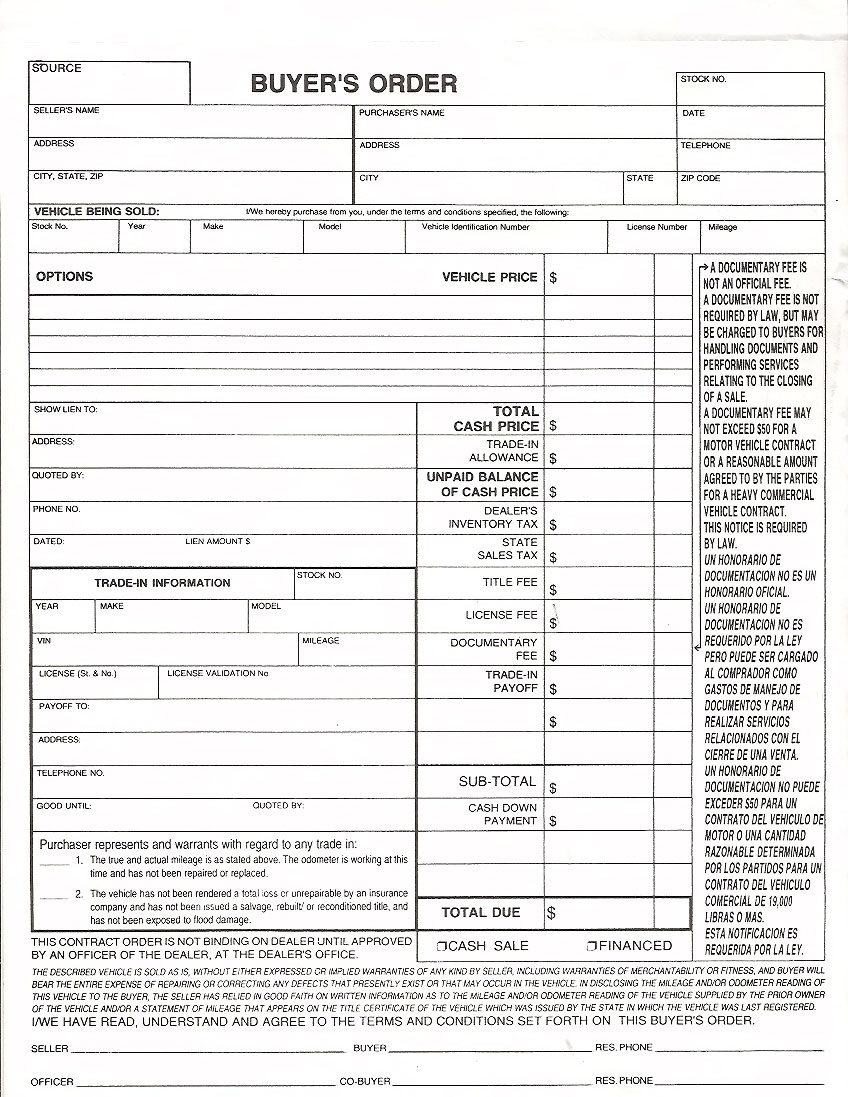

Steps to buy insurance for your used car

- Assess your needs: Determine the level of coverage you need base on your vehicle’s value and your financial situation.

- Get quotes: Compare quotes from multiple insurers to find the best rate.

- Review the policy: Understand the terms and conditions, include any exclusions or limitations.

- Purchase the policy: Choose the policy that comfortably fit your needs and budget.

Real life example

Consider the case of Sarah, a young professional who buy a use sedan. Initially, she opts for minimal coverage to save on premiums. Notwithstanding, after a minor accident, shefacese hefty repair costs that her insurance didn’t cover. This experiencteachesch her the importance of comprehensive coverage, lead her to upgrade her policy to include collision and comprehensive covera .

Common mistakes to avoid

- Underinsured: Choose minimal coverage to save money can lead to significant expenses late.

- Not compare quotes: Fail to shop some can result in overpay for insurance.

- Ignore discounts: Many insurers offer discounts for safe driving, bundle policies, or have anti theft devices.

Conclusion

Purchase insurance for a use car doesn’t have to be daunted. By understand your needs, explore your options, and avoid common pitfalls, you can secure the protection you need at a price you can afford. This guide serve as a starting point, encourage you to delve deep and consult with professionals to tailor your insurance policy efficaciously

Source: carmudi.com.pH

Source: carmudi.com.pH